BELOW is a screenshot from a quiz about famous economists that can be found here.

Notice the 3 minute time limit.

That means that even Googlers will have to be quick in order to answer in time!

Let us know how long you take to complete it......

Monday, 7 February 2011

Thursday, 3 February 2011

No 177: The first economist and the first economic question

ACCORDING to a book I am currently reading - Dr. Strangelove's Game: A Brief History of Economic Genius - the first person who can be clearly recognised as an economic thinker was Sir William Petty (1623-1687). (This links to a Wikipedia article about him.)

Not the best looking man who ever lived, he was called a "bumptious and somewhat unpleasant man."

One reason why he was so important is that he seems to be the first person to have tred to put a monetary value on everything, with what he called "political arithmatiek". This included human life.

In measuring the value of the labour working on his vast lands in Ireland, he valued the worth of each working man at twenty times his annual income.

Doing this was an important development in the history of human thought. Firstly, it made it "possible to calculate the loss to a nation by deaths, especially in times of war and plague" (Dr Strangelove's Game p.21). In addition, a money value for everything "gave a common denominator against which everything could be measured" (p.22).

The true monetary value of a human life is a question economists are trying to answer even now, centuries later.

Some people are very uncomfortable with the idea of trying to do this.

However, if we believe that governments should take all costs and benefits into account before deciding whether or not to spend money on a project, the possible loss of human life must be included. For example, when deciding to build a road, the possible costs of traffic accidents need to be calculated.

This links to a very simplistic yet fun way of calculating your own worth. As you can see, I have tried it:

(If you try it, you need to make sure you click "scan" at the end to see the results.)

The maximum value of $10 would be achieved, according to the site, if you were a male, 33 years old, from Luxembourg, with a perfect body.

When I tried this again, with all the information the same except being a Mrs. Spottiswoode, instead of Mr, my value had fallen to $4.43. So it seems that a British woman is worth about a third less than a British man.........

Of course, this is fairly primative stuff. It's really just to stimulate discussion I think, so please don't take it too seriously!

However, there are of course serious issues here.

For instance, this article talks about how the Environmental Protection Agency (EPA) of the USA, in 2008 reduced its calculation of the value of an American human life from $7.8 million down to $6.9 million.

Critics of this decision speculated that the agency made the change so the Bush government could avoid tougher regulations on air pollution, water pollution, greenhouse gas emissions, and other environmental problems.

This article talks about valuing a year of human life. Doing this is important in assessing whether medical insurance companies should offer to pay for the cost of a new medical treatment or piece of equipment. Previously, insurance companies calculated that to make a treatment worth its cost, it must guarantee one year of "quality life" for $50,000 or less. However, economists from Stanford University have written a report arguing it should go up to $129,000.

It seems then that the issue of the value of human life is as controversial now as it was in Sir William Petty's time.

It also seems that we still very far away from agreeing what that value should be.

Not the best looking man who ever lived, he was called a "bumptious and somewhat unpleasant man."

One reason why he was so important is that he seems to be the first person to have tred to put a monetary value on everything, with what he called "political arithmatiek". This included human life.

In measuring the value of the labour working on his vast lands in Ireland, he valued the worth of each working man at twenty times his annual income.

Doing this was an important development in the history of human thought. Firstly, it made it "possible to calculate the loss to a nation by deaths, especially in times of war and plague" (Dr Strangelove's Game p.21). In addition, a money value for everything "gave a common denominator against which everything could be measured" (p.22).

The true monetary value of a human life is a question economists are trying to answer even now, centuries later.

Some people are very uncomfortable with the idea of trying to do this.

However, if we believe that governments should take all costs and benefits into account before deciding whether or not to spend money on a project, the possible loss of human life must be included. For example, when deciding to build a road, the possible costs of traffic accidents need to be calculated.

This links to a very simplistic yet fun way of calculating your own worth. As you can see, I have tried it:

(If you try it, you need to make sure you click "scan" at the end to see the results.)

The maximum value of $10 would be achieved, according to the site, if you were a male, 33 years old, from Luxembourg, with a perfect body.

When I tried this again, with all the information the same except being a Mrs. Spottiswoode, instead of Mr, my value had fallen to $4.43. So it seems that a British woman is worth about a third less than a British man.........

Of course, this is fairly primative stuff. It's really just to stimulate discussion I think, so please don't take it too seriously!

However, there are of course serious issues here.

For instance, this article talks about how the Environmental Protection Agency (EPA) of the USA, in 2008 reduced its calculation of the value of an American human life from $7.8 million down to $6.9 million.

Critics of this decision speculated that the agency made the change so the Bush government could avoid tougher regulations on air pollution, water pollution, greenhouse gas emissions, and other environmental problems.

This article talks about valuing a year of human life. Doing this is important in assessing whether medical insurance companies should offer to pay for the cost of a new medical treatment or piece of equipment. Previously, insurance companies calculated that to make a treatment worth its cost, it must guarantee one year of "quality life" for $50,000 or less. However, economists from Stanford University have written a report arguing it should go up to $129,000.

This suggest that by placing too low a value on human life, insurance companies have been avoiding paying for medical treatment that they should have been providing.

It also seems that we still very far away from agreeing what that value should be.

Sunday, 30 January 2011

No 176: Competition!!!!!!

IT'S been a long time since this blog had its last competition, so I thought it was time for a new one. The competition will be an .......................

Here's the story. Last year, a student started talking about

It took me a while to realise that they meant "incumbent firms" (firms that are already in a particular market when other firms are trying to enter it).

We all thought this was very funny, so when we got to our next topic, this is how I titled the Powerpoint:

ECONOMICS VEGETABLES COMPETITION

Here's the story. Last year, a student started talking about

CUCUMBER FIRMS

It took me a while to realise that they meant "incumbent firms" (firms that are already in a particular market when other firms are trying to enter it).

We all thought this was very funny, so when we got to our next topic, this is how I titled the Powerpoint:

TRADE ONIONS

So, to enter the competition, please post suggestions about other economics vegetables.

An interesting book about Economics will be the prize for whoever I think has the funniest suggestion.

An interesting book about Economics will be the prize for whoever I think has the funniest suggestion.

Sunday, 23 January 2011

No 175: About Loose and Tight Policy

AS YOU will know if you took the Module 2 exam on Wednesday, the first question in it asked about "loose" monetary policy.

It occured to me that the terms "tight" and "loose" may not be that familiar to you, since they don't always appear in textbooks.

But then I remembered all of you are of course doing lots of Economics reading, so have looked at this week's Economist........

This extremely relevant article (which you should read and all my students will be reading) starts:

The monetary tap works mainly by controlling credit in the economy through manipulation of interest rates.

The fiscal tap works by alterations in taxation, government spending, and any borrowing it requires.

Both taps influence the amount of demand that flows through the economy, which in turn affects the amount of goods and services produced, and therefore also the levels of profit, wages and jobs.

Here, the government (or in the UK, more accurately the Bank of England) has loosened the Monetary Policy tap. Lower interest rates encourage households and firms to take out credit and then spend it, increasing the flow of demand in the economy.

Here, fiscal policy has been loosened. Taxes have been cut, and/or government spending has been increased. This gives people more money, therefore adding to the flow of demand.

During the Credit Crunch, various factors - lack of bank lending, falling wealth, plunging confidence, lack of profits - all led to the total (or aggregate) level of demand being at an extremely low level.

So, it is generally agreed that the right government action in this situation to use both loose monetary and fiscal policy. It is hoped that the economy can recover from recession by the government causing demand to increase in the economy.

This is the current situation in the UK. The government has decided to tighten fiscal policy.

In its original (Keynesian) form, the idea was that loose fiscal policy in bad times would be paid for with money the government had saved up in the good times. Few governments do that now, meaning that money must be borrowed to pay for it.

However, at certain point, too much government debt endangers the ability of governments to borrow money in the future. This would be a disaster, since government would be unable to pay even for its most essential services such as health care and education.

Therefore, it was decided to tighten the fiscal policy tap. But some economists fear that fiscal policy has been tightened too early, and that this will damage the recovery.

If a recovery becomes a boom, a government will tighten monetary policy also. This is to avoid demand overflowing. If there is demand which is not realised (that is, there are not enough goods and services for everyone who want them), prices shoot up.

The resulting inflation is seen by many economists as an economic problem which can be even worse than unemployment.

There is increasing inflation in the UK at the moment, and this is worrying. However, the cause is not too much demand in the economy. Instead, it is due to rising prices of essential commodities such as food and oil, as well as a rise in VAT (part of the tightening in fiscal policy).

The government could decide to tighten the monetary policy tap to combat this.

However, the fear is that the economy is not strong enough to continue to recover by itself with both tight monetary and tight fiscal policy.

As with most economic policy decisions, it is not so much the policy you use as the time that you decide to use it.

It occured to me that the terms "tight" and "loose" may not be that familiar to you, since they don't always appear in textbooks.

But then I remembered all of you are of course doing lots of Economics reading, so have looked at this week's Economist........

This extremely relevant article (which you should read and all my students will be reading) starts:

THE script for 2011 had been well rehearsed. The Treasury’s fierce fiscal retrenchment would undoubtedly hurt the economic recovery. But the Bank of England would add balm by maintaining an extraordinarily loose monetary stance. Just three weeks into the new year, however, surging inflation has disrupted the story. The worry is that this could endanger the recovery by forcing a premature tightening in monetary policy.

So exactly what do these terms "loose" and "tight" refer to, and in which situation can they be used appopriately to describe government policy?

The first thing to say is that "loose" policy is also often referred to as "expansionary" policy, and that "tight" policy is often called "deflationary" policy.

The second basic concept is that loose and tight as terms can be used to refer either to monetary policy or fiscal policy.

The monetary tap works mainly by controlling credit in the economy through manipulation of interest rates.

The fiscal tap works by alterations in taxation, government spending, and any borrowing it requires.

Both taps influence the amount of demand that flows through the economy, which in turn affects the amount of goods and services produced, and therefore also the levels of profit, wages and jobs.

Here, the government (or in the UK, more accurately the Bank of England) has loosened the Monetary Policy tap. Lower interest rates encourage households and firms to take out credit and then spend it, increasing the flow of demand in the economy.

Here, fiscal policy has been loosened. Taxes have been cut, and/or government spending has been increased. This gives people more money, therefore adding to the flow of demand.

During the Credit Crunch, various factors - lack of bank lending, falling wealth, plunging confidence, lack of profits - all led to the total (or aggregate) level of demand being at an extremely low level.

So, it is generally agreed that the right government action in this situation to use both loose monetary and fiscal policy. It is hoped that the economy can recover from recession by the government causing demand to increase in the economy.

This is the current situation in the UK. The government has decided to tighten fiscal policy.

In its original (Keynesian) form, the idea was that loose fiscal policy in bad times would be paid for with money the government had saved up in the good times. Few governments do that now, meaning that money must be borrowed to pay for it.

However, at certain point, too much government debt endangers the ability of governments to borrow money in the future. This would be a disaster, since government would be unable to pay even for its most essential services such as health care and education.

Therefore, it was decided to tighten the fiscal policy tap. But some economists fear that fiscal policy has been tightened too early, and that this will damage the recovery.

If a recovery becomes a boom, a government will tighten monetary policy also. This is to avoid demand overflowing. If there is demand which is not realised (that is, there are not enough goods and services for everyone who want them), prices shoot up.

The resulting inflation is seen by many economists as an economic problem which can be even worse than unemployment.

There is increasing inflation in the UK at the moment, and this is worrying. However, the cause is not too much demand in the economy. Instead, it is due to rising prices of essential commodities such as food and oil, as well as a rise in VAT (part of the tightening in fiscal policy).

The government could decide to tighten the monetary policy tap to combat this.

However, the fear is that the economy is not strong enough to continue to recover by itself with both tight monetary and tight fiscal policy.

As with most economic policy decisions, it is not so much the policy you use as the time that you decide to use it.

Thursday, 20 January 2011

No 174: Current UK Economic Statistics

MOST of you in my current classes have moved on to Macroeconomics. One very important piece of knowledge to have is an idea about the current state of the British economy.

So the deal is, I will upate the key economic indicators about the UK, as long as you promise to try and remember some of them for the exams.

DEAL OR NO DEAL?

Deal? Great, here are the current figures:

Economic Growth

Inflation

So the deal is, I will upate the key economic indicators about the UK, as long as you promise to try and remember some of them for the exams.

DEAL OR NO DEAL?

Deal? Great, here are the current figures:

Economic Growth

Inflation

Wednesday, 5 January 2011

No 173: Top 10 Economics Stories of 2010

CLICK on this link to get to a sideshow from the "Daily Telegraph" of its top 10 economics new stories of 2010.

Here is a list of which stories they have included:

1. Deficit, debt and austerity worries

2. Government debt problems for European countries

3. Currency wars

4. Global imbalances in trade

5. China's continued growth

6. Difficulties with job creation

7. Inflation and interest rate decsisions

8. Problems for the Bank of England's monetary policy

9. The formation of the Office for Budget Responsibility

10. Unpredictable UK growth

Therefore, please make sure you have a look. There may even be an exciting quiz about them next week.....

If you want more, here is a link to the Telegraph's Top 10 Banking Stories of 2010.

If you want more, here is a link to the Telegraph's Top 10 Banking Stories of 2010.And if you'd like even more, this is a link to "The Week" magazine's Most Newsworthy Dogs of 2010, including the sad story of Target, the war hero dog :,(

Labels:

banking,

China,

creditcrunch,

GDP,

inflation,

monetary,

newspaper,

trade,

unemployment

Sunday, 2 January 2011

No 172: Tutor2u Revision

HERE is a link to the Tutor2u website and all of its posts regarding exam revision:

http://www.tutor2u.net/blog/index.php/economics/tagged/tag/revision/

It is worth checking this every few days since new and useful stuff is being put up there regularly.

Saturday, 1 January 2011

HAPPY HAPPY HAPPY HAPPY etc etc

WELL here we are in 2011 (today is 1 1 11 if you didn't notice, and now it's almost 11.11 o'clock on 1 1 11 so nearly 11 11 1 1 11) and as fits a new year, we are all looking to improve.

And the improvement I want to make in this blog this year is

MORE INVOLVEMENT OF YOU ....... THE READERS

It's lonely hard work producing this blog  and it would help me a lot if you could interact just a little more.

and it would help me a lot if you could interact just a little more.

The first step you can see below. All future posts will have a "like this" button at the end, for you to click if you enjoyed the particular post and therefore stopping me from further feelings of loneliness and more .

.

More seriously, it gives me an idea of which types of articles are being well-read and are popular with you.

Go on, give it a try now.

And of course, if you wish to leave comments, that's even more welcome!

The first step you can see below. All future posts will have a "like this" button at the end, for you to click if you enjoyed the particular post and therefore stopping me from further feelings of loneliness and more

More seriously, it gives me an idea of which types of articles are being well-read and are popular with you.

Go on, give it a try now.

And of course, if you wish to leave comments, that's even more welcome!

Wednesday, 29 December 2010

No 171: 2010 in 9 Charts

I HAVEN'T before simply just copied an article straight into this blog. However, this recent article from "The Economist" is so informative, so useful, that I believe EVERYONE of you should try to read it, even though it is fairly advanced in places.

THE global property bust that pulled the world into recession in 2008 began to lift in 2010. House prices turned up in Britain and stabilised in America (chart 1) but slid further in Spain. The process of deleveraging kept rich-world inflation subdued (chart 2) while robust demand and loose monetary policy let it accelerate in India and China. By late 2010 output and employment had turned up in most rich countries but not enough to regain pre-crisis levels (chart 3).

Bowing to American pressure, China allowed the yuan to rise slightly (chart 4); higher inflation meant that in real terms it rose considerably more. Japan watched in alarm as a rising yen (chart 5) threatened its export-led recovery. Europe trembled as its sovereign-debt crisis undermined the euro.

Sadly, austerity did not provide the hoped-for relief: peripheral European government-bond yields continued to rise relative to Germany’s (chart 7).

Bonds’ best days may be over everywhere. In emerging markets and America bond prices increased through most of 2010 (chart 8) then fell as America’s economy sprang to life and investors flocked to equities. Commodities trounced both stocks and bonds (chart 9). Bulls attribute this to global growth, especially in the emerging world; bears cite a desire for inflation hedges. The tension between them will drive markets in 2011.

CHARTS OF 2010 - A YEAR IN NINE PICTURES

THE global property bust that pulled the world into recession in 2008 began to lift in 2010. House prices turned up in Britain and stabilised in America (chart 1) but slid further in Spain. The process of deleveraging kept rich-world inflation subdued (chart 2) while robust demand and loose monetary policy let it accelerate in India and China. By late 2010 output and employment had turned up in most rich countries but not enough to regain pre-crisis levels (chart 3).

Bowing to American pressure, China allowed the yuan to rise slightly (chart 4); higher inflation meant that in real terms it rose considerably more. Japan watched in alarm as a rising yen (chart 5) threatened its export-led recovery. Europe trembled as its sovereign-debt crisis undermined the euro.

Rich-world budgets remained deeply in deficit but at least those gaps generally shrank, most of all in countries, like Greece, undergoing austerity (chart 6).

Sadly, austerity did not provide the hoped-for relief: peripheral European government-bond yields continued to rise relative to Germany’s (chart 7).

Bonds’ best days may be over everywhere. In emerging markets and America bond prices increased through most of 2010 (chart 8) then fell as America’s economy sprang to life and investors flocked to equities. Commodities trounced both stocks and bonds (chart 9). Bulls attribute this to global growth, especially in the emerging world; bears cite a desire for inflation hedges. The tension between them will drive markets in 2011.

Tuesday, 28 December 2010

No 168: Fun with Google Ngram

THE tools on "Google Labs" are really cool. For example, Google Ngram allows a user to search the millions of books scanned into Google Books, to find how often different words or names have appeared in the past.

This can be very interesting for us economists.

For instance, this is what happens if you search using "inflation" and "unemployment":

Inflation is the first of the 2 terms to start to be written about, but it is overtaken by unemployment in about 1905. Both of the terms, but especially unemployment, show a huge increase during the Great Depression of the 1920s and 1930s.

After World War 2, the incidence of inflation increases and that of unemployment falls, perhaps due to the Phillips' Curve and its emphasis of the correlation between the two. In the 1970s, inflation leaps up to the same level as unemployment, at the same time as the world economic crisis of the time which saw high levels of both.

The peak for both came during the recession of the early 1980s.

Since then, the frequency drops, possibly due to the relatively good economic climate until the Credit Crunch. It will be interesting to see how it has increased during our current economic crisis, in a few years when the data is available.

Here are some more Ngram graphs:

Not quite sure about Karl Marx's popularity around 1700, about 120 years before he was born! I guess this also shows how Adam Smith's has continued to be a very important figure, even when Marx was at his most influential.

Two more - war and peace first:

How about tea and coffee:

Come on, then, why don't you have a go? Just go to Google Ngram and then tell us about the graph you made.

(Technical note: choosing the option to search through "English One Million" gives a more even sample over the different years.)

This can be very interesting for us economists.

For instance, this is what happens if you search using "inflation" and "unemployment":

Let's be clear what this graph shows: how often books contain the words "inflation" and "unemployment" between 1800 and 2008.

Firstly, it is clear that few writers talked about either inflation or unemployment until about 1870. This is probably because early Economics was almost universally concerned with microeconomics.

After World War 2, the incidence of inflation increases and that of unemployment falls, perhaps due to the Phillips' Curve and its emphasis of the correlation between the two. In the 1970s, inflation leaps up to the same level as unemployment, at the same time as the world economic crisis of the time which saw high levels of both.

The peak for both came during the recession of the early 1980s.

Since then, the frequency drops, possibly due to the relatively good economic climate until the Credit Crunch. It will be interesting to see how it has increased during our current economic crisis, in a few years when the data is available.

Here are some more Ngram graphs:

Not quite sure about Karl Marx's popularity around 1700, about 120 years before he was born! I guess this also shows how Adam Smith's has continued to be a very important figure, even when Marx was at his most influential.

Two more - war and peace first:

How about tea and coffee:

Come on, then, why don't you have a go? Just go to Google Ngram and then tell us about the graph you made.

(Technical note: choosing the option to search through "English One Million" gives a more even sample over the different years.)

Labels:

data,

fun,

greatesteconomists,

inflation,

infographic,

unemployment

Thursday, 9 December 2010

No 167: Three More Student Stories

SO we're now on to the third set of story summaries written by A2 students. Once again I am impressed by the high standard of English and Economics shown in this work. Well done!

However, I teach 17 A2 students and have only received 11 stories...... oh dear some of you may be in trouble!

On December 4th, in some cities in the UK such as London and Brighton, there were demonstrations against tax avoidance of the owner of Topshop, Sir Phillip Green. They criticise not only Sir Green but also the government itself by saying "If you want to sell your products, pay your tax" and "Nick Clegg, shame on you, shame on you for turning blue". This event gives warning and criticisms of the government regulation over tax.

http://www.dailymail.co.uk/news/article-1335632/Sir-Philip-Greens-flagship-Topshop-closes-protests-taxes-cause-mayhem.html?ITO=1490

The revival of the UK manufacturing sector is due to the strong demand from overseas consumers and a big improvement in productivity, which gives a big hand to the country's recovery as it currently accounts for 13% of the UK's total economic output. However, to maintain the revival of the sector, government should also play a role in it,such as put in more spending,or make some looser policies to attract the firms to make even better performance in certain sectors.

http://www.bbc.co.uk/news/business-11921894

Due to weather conditions the Royal Mail is currently not providing its guaranteed next day delivery. Also Amazon one of the retailers said that items might be delayed. Moreover some of the petrol stations had problems in getting fuel into certain areas, especially in Scotland. On the other hand, because there are fewer vehicles on the road during these days, there is less demand for petrol.

A spokesman for the Department of Energy and Climate change said that fuel supply companies are doing their best in order to supply road transport fuels, however in some parts of the UK, weather conditions are causing problems.

In addition the Independent Retailers Association stated that in Scotland and East England many independent petrol retailers are in danger of running out of petrol and diesel. Those filling stations that are in rural areas are most vulnerable.

Tesco, one of the UK’s largest petrol retailers said that all their tankers are operating and that there are no stations closing down or reporting shortages. Together with other supermarkets Tesco had no problems with food supply shortages.

However, current weather conditions affect positively on other businesses. For example Marks and Spencer reported that demand for thermal clothing in past weeks had grown by 121%. Furthermore Asda sold about 100,000 de-icers for car windows.

So according to Howard Archer early changes in weather had impact mostly on retailers.

ttp://www.bbc.co.uk/news/business-11904765

However, I teach 17 A2 students and have only received 11 stories...... oh dear some of you may be in trouble!

DEMONSTRATIONS AGAINST TAX AVOIDANCE by Kana Maniwa

On December 4th, in some cities in the UK such as London and Brighton, there were demonstrations against tax avoidance of the owner of Topshop, Sir Phillip Green. They criticise not only Sir Green but also the government itself by saying "If you want to sell your products, pay your tax" and "Nick Clegg, shame on you, shame on you for turning blue". This event gives warning and criticisms of the government regulation over tax.

http://www.dailymail.co.uk/news/article-1335632/Sir-Philip-Greens-flagship-Topshop-closes-protests-taxes-cause-mayhem.html?ITO=1490

UK MANUFACTURING 'POWERING AHEAD' by Alan Chan

The revival of the UK manufacturing sector is due to the strong demand from overseas consumers and a big improvement in productivity, which gives a big hand to the country's recovery as it currently accounts for 13% of the UK's total economic output. However, to maintain the revival of the sector, government should also play a role in it,such as put in more spending,or make some looser policies to attract the firms to make even better performance in certain sectors.

http://www.bbc.co.uk/news/business-11921894

SNOW CAUSES DISTRIBUTION PROBLEMS by Rauan

Due to weather conditions the Royal Mail is currently not providing its guaranteed next day delivery. Also Amazon one of the retailers said that items might be delayed. Moreover some of the petrol stations had problems in getting fuel into certain areas, especially in Scotland. On the other hand, because there are fewer vehicles on the road during these days, there is less demand for petrol.

A spokesman for the Department of Energy and Climate change said that fuel supply companies are doing their best in order to supply road transport fuels, however in some parts of the UK, weather conditions are causing problems.

In addition the Independent Retailers Association stated that in Scotland and East England many independent petrol retailers are in danger of running out of petrol and diesel. Those filling stations that are in rural areas are most vulnerable.

Tesco, one of the UK’s largest petrol retailers said that all their tankers are operating and that there are no stations closing down or reporting shortages. Together with other supermarkets Tesco had no problems with food supply shortages.

However, current weather conditions affect positively on other businesses. For example Marks and Spencer reported that demand for thermal clothing in past weeks had grown by 121%. Furthermore Asda sold about 100,000 de-icers for car windows.

So according to Howard Archer early changes in weather had impact mostly on retailers.

ttp://www.bbc.co.uk/news/business-11904765

Wednesday, 8 December 2010

No 166: Next Four Student Stories

FOUR more excellent news story summaries from A2 students. Good work!

AMERICA'S JOBLESS RECOVERY by Abdul Abdulrahim

Nearly in every sector the U.S. seems to be picking up pace, spending has been become strong, and the latest figures on pending home sales suggest that even housing markets may be coming back from their deep slump.

The growth seems to be everywhere except one of the key areas —labour markets. Employment in America turned in a surprisingly poor performance in November, indicating that recovery is not creating enough jobs.

The unemployment rate rose to 9.8%, its highest level since April and close to the 10.1% recession peak. At 15.1m, the number of unemployed workers rose back to its April high (though some of this increase was due to new entrants to the labour force).

Many of these workers are now rely on unemployment benefits. Congress has yet to reauthorise the emergency benefits package, as it has done so many times through the recession. Some 2m jobless workers may lose benefits by the end of 2010, and perhaps 4m or more will lose them by April (The Economist).

The November figures may be revised up in future months to show a better performance (like the previous months). The U.S. labour markets has yet to generate job growth sufficient to bring down the unemployment rate of the country. However the pace of recovery has been improving. All the same, policymakers in Washington considering the extension of unemployment benefits and tax cuts should pay attention to the obvious weakness in labour markets. They can and should make sure that November's number remains an anomaly(out of what is expected).

(http://www.economist.com/blogs/freeexchange/2010/12/americas_jobless_recovery&fsrc=nwl)

OIL PRICES REACH POST-CRISIS TWO-YEAR HIGH by Eunice Aw

Oil prices reached a record high since the financial crisis in 2008.

The factors that contributed to this rise in oil prices included an increasing demand for oil due to the global economic recovery and the cold weather.

The rising demand is also due to the weakening of the US dollar. The weak US currency makes oil less expensive as it increases the purchasing power of currencies that gain in value against the dollar. Hence, the demand for oil increases. However, the producers may restrict the supply of oil as they are earning less profit from the US dollar. This results in a rise in oil prices.

http://www.bbc.co.uk/news/business-11917152

SPANISH AIRPORTS FACING POST-STRIKE BACKLOG by Dheeya Rizmie

The unexpected, unofficial strike of air traffic controllers in Spain has lead to the forced cancellations of numerous flights, both departing and arriving in Spain, with more than 250,000 people being affected. The strike came after the government decided to introduce a period of austerity (in order to reduce their budget deficit) which may severely affect the wages of controllers. This decision came after an ongoing dispute acout their work hours.

http://www.bbc.co.uk/news/world-europe-11921539

FUTURE UK GROWTH by Valerija Artemjeva

The economy will grow by less than expected in 2011(the UK's GDP was predicted to be 2.2% but now the it is predicited to be 1.9%), but growth in 2012 will be better than predicted, the British Chambers of Commerce forecasts. It upgraded its GDP growth forecasts for 2012 from 1.8% to 2.1% - but that was still significantly lower than the OBR's 2.6% estimate.

http://www.bbc.co.uk/news/uk-11920548

AMERICA'S JOBLESS RECOVERY by Abdul Abdulrahim

Nearly in every sector the U.S. seems to be picking up pace, spending has been become strong, and the latest figures on pending home sales suggest that even housing markets may be coming back from their deep slump.

The growth seems to be everywhere except one of the key areas —labour markets. Employment in America turned in a surprisingly poor performance in November, indicating that recovery is not creating enough jobs.

The unemployment rate rose to 9.8%, its highest level since April and close to the 10.1% recession peak. At 15.1m, the number of unemployed workers rose back to its April high (though some of this increase was due to new entrants to the labour force).

Many of these workers are now rely on unemployment benefits. Congress has yet to reauthorise the emergency benefits package, as it has done so many times through the recession. Some 2m jobless workers may lose benefits by the end of 2010, and perhaps 4m or more will lose them by April (The Economist).

The November figures may be revised up in future months to show a better performance (like the previous months). The U.S. labour markets has yet to generate job growth sufficient to bring down the unemployment rate of the country. However the pace of recovery has been improving. All the same, policymakers in Washington considering the extension of unemployment benefits and tax cuts should pay attention to the obvious weakness in labour markets. They can and should make sure that November's number remains an anomaly(out of what is expected).

(http://www.economist.com/blogs/freeexchange/2010/12/americas_jobless_recovery&fsrc=nwl)

OIL PRICES REACH POST-CRISIS TWO-YEAR HIGH by Eunice Aw

Oil prices reached a record high since the financial crisis in 2008.

The factors that contributed to this rise in oil prices included an increasing demand for oil due to the global economic recovery and the cold weather.

The rising demand is also due to the weakening of the US dollar. The weak US currency makes oil less expensive as it increases the purchasing power of currencies that gain in value against the dollar. Hence, the demand for oil increases. However, the producers may restrict the supply of oil as they are earning less profit from the US dollar. This results in a rise in oil prices.

http://www.bbc.co.uk/news/business-11917152

SPANISH AIRPORTS FACING POST-STRIKE BACKLOG by Dheeya Rizmie

The unexpected, unofficial strike of air traffic controllers in Spain has lead to the forced cancellations of numerous flights, both departing and arriving in Spain, with more than 250,000 people being affected. The strike came after the government decided to introduce a period of austerity (in order to reduce their budget deficit) which may severely affect the wages of controllers. This decision came after an ongoing dispute acout their work hours.

http://www.bbc.co.uk/news/world-europe-11921539

FUTURE UK GROWTH by Valerija Artemjeva

The economy will grow by less than expected in 2011(the UK's GDP was predicted to be 2.2% but now the it is predicited to be 1.9%), but growth in 2012 will be better than predicted, the British Chambers of Commerce forecasts. It upgraded its GDP growth forecasts for 2012 from 1.8% to 2.1% - but that was still significantly lower than the OBR's 2.6% estimate.

http://www.bbc.co.uk/news/uk-11920548

Tuesday, 7 December 2010

No 165: World Clock

HERE is a screenshot of the "World Clock":

As you can see (but not too clearly, trying a different screenshot app....) the clock shows you information about different stats about the whole world: births, deaths, prison growth, car production.

However, to get the real fun out of it, you need to actually watch the clock in live time: click here to get to it.

Right, I'm going to watch the clock for the next 60 seconds and see what happens in the world....

Ok, I'm back. In the world in the last 60 seconds there was:

Wow, got all of a bit philosophical there, apologies!

As you can see (but not too clearly, trying a different screenshot app....) the clock shows you information about different stats about the whole world: births, deaths, prison growth, car production.

However, to get the real fun out of it, you need to actually watch the clock in live time: click here to get to it.

Right, I'm going to watch the clock for the next 60 seconds and see what happens in the world....

Ok, I'm back. In the world in the last 60 seconds there was:

- a 147 person growth in world population due to

- 256 births minus

- 109 deaths of which

- 22 were because of cardiovascular problems, 2 from traffic accidents, 1 from poisonings and also

- 1 illegal immigrant entered the USA

- 2 couples got divorced in the USA while

- 88 abortions took place across the world

- 25 hectares of forest were lost

- 57,851 barrels of oil were produced and also

- 69 cars, 208 bicycles and 161 computers.

Wow, got all of a bit philosophical there, apologies!

Monday, 6 December 2010

No 164: First Four Student Stories

SO HERE are the first of the summaries written by my A2 students about recent economic stories. Good work everyone!

EUROPEAN COUNTRIES AND THE EURO by Queena Wong

Countries in Europe like Spain , Italy , Portugal and Ireland

(See

(See

IS HAPPINESS ALL ABOUT MONEY? by Yana Geshko

In the article ideas about human well-being and income are discussed. Should government put people's happiness above people's prosperity as the aim that drives their policy- making decisions? Though peoples' answers don't show that money is everything, they usually make a decision relying on the possibility to save or earn money.

(See : http://www.economist.com/node/17578888 )

CAMERON'S HAPPINESS INDEX by Iris

David Cameron has asked the Office of National Statistics to measure the country's "general well-being" in terms of what is known as the index of happiness. The government is intending to use this statistical information when it comes to policy making.However,this rather creative new strategy is not favoured by the majority of people who is concerned about the feasibility of this,because it is not only difficult to define "happiness",but is also time-consuming to collect data from a large and representative sample.

CADBURY AGREES TO KRAFT'S TAKEOVER BID by Rachel Yoo

Cadbury will benefit from the supply chain of a larger company.

For example, its addition to the Kraft will allow the combined company to have an even a broader reach around the world.

Also, there is a big chance to generate cost savings.

Also, there is a big chance to generate cost savings.

However as Cadbury, the 186-year-old British company, was acquired by an American company there were public protests,

http://stocks.investopedia.com/stock-analysis/2010/What-Happens-When-Kraft-And-Cadbury-Merge-KFT-CBY-WEN-MCD-TGT0127.aspx?partner=tickerspy

http://stocks.investopedia.com/stock-analysis/2010/What-Happens-When-Kraft-And-Cadbury-Merge-KFT-CBY-WEN-MCD-TGT0127.aspx?partner=tickerspy

Friday, 3 December 2010

No 162: Some Interesting Numbers from "Private Eye"

I DON'T have a particular newspaper that I read every day. However, I do make sure that every week I read "The Economist" (which hopefully you have heard of already), and "Private Eye".

You can probably tell from this week's cover the kind of magazine the Private Eye is....

In my opinion, satirical magazines like this, who watch very carefully what government and other powerful people do, are extremely important. This may be why usually one of the first acts of a dictator is to close down these kinds of publications. Plus, Private Eye is funny!

However, I am not the only person who believes in the importance of having a strong opposition to the government.

As reported in last weeks "Economist":

"In a video shown on state television, President Dmitry Medvedev said that Russia’s political system was showing signs of “stagnation”, and that the lack of serious opposition meant that Russia’s ruling party, United Russia, was in danger of “bronzing over”."

You can probably tell from this week's cover the kind of magazine the Private Eye is....

In my opinion, satirical magazines like this, who watch very carefully what government and other powerful people do, are extremely important. This may be why usually one of the first acts of a dictator is to close down these kinds of publications. Plus, Private Eye is funny!

However, I am not the only person who believes in the importance of having a strong opposition to the government.

As reported in last weeks "Economist":

"In a video shown on state television, President Dmitry Medvedev said that Russia’s political system was showing signs of “stagnation”, and that the lack of serious opposition meant that Russia’s ruling party, United Russia, was in danger of “bronzing over”."

Now I don't want to say too much about Russian politics, since it not something I know a lot about. However, it does seem to me a bit strange that one of the leaders of a political party which has been well known for trying to silence opposition, is now complaining because now there is no opposition.......

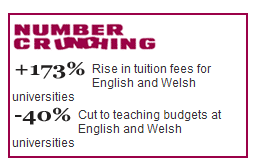

In any case, back to "Private Eye". One feature I like in it is called "Number Crunching", and here are a few examples:

Subscribe to:

Posts (Atom)