On Thursday the Bank of England announced QE was ending (they also kept the base rate at 0.5%).

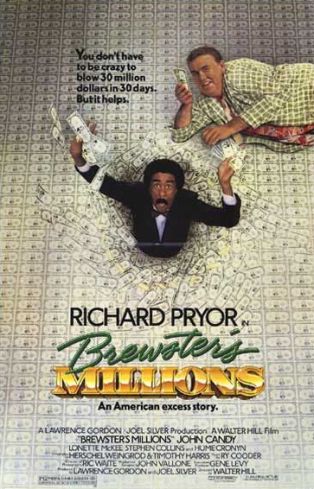

This is because they have spent all of the £200 billion allocated for QE. Imagine having £200 billion to spend, and doing it in less than a year (QE started in March 2009). Reminds me of this old movie.....

which is obviously what the person who made the picture below was thinking about, too.

But back to the serious economics, here is a link to the BBC news story about the end of UK quantitative easing, which includes the images I've copied below.

There appears to have been a bit of a problem about getting banks to do this. At least some seem to have preferred to have used the free cash to make even more money for themselves by buying shares on the stock markets, which recovered strongly last year. Therefore, we're not really sure yet if all this QE cash has helped as much as hoped.

Or much at all.

There may be buyers for bonds if the economy improves. But this is not all the B of E has been buying with its QE money. There were also the so-called "toxic assets" that the banks had no chance of getting rid of until QE appeared. These were mainly investment "vehicles" derived from repayments on millions of sub-prime ("sub-prime" means "less than the best") mortgages.

This video talks about sub-prime in both a funny and scary way:

I suppose though if the economy recovers, these kind of risky but high paying investments may become attractive again. Hopefully this won't create the same kind of problems these kind of risky but high paying investments caused only a couple of years ago (that led to the need for quantitative easing in the first place).

See also Post 18 for some great videos about QE.

No comments:

Post a Comment