TO YOUR right you can see a new poll. |t is a MCQ taken from a Module 1 examination. I have chosen it because the topic of efficiency is key to being successful in the exam.

Markets (free) are efficient when they work well, providing both the correct amounts of goods required (allocative efficiency) and causing production to happen with the lowest possible amount of resources which is often the same as producing with lowest costs (productive efficiency).

The ability of a free market to self-correct and reach equilibrium can lead to allocative efficiency. Competition drives down costs and may cause productive efficiency.

Markets fail when certain problems (monopoly power, externalities, information failure, etc) stop them from being efficient. When this happens governments may take action to try and correct the problem.

UNDERSTANDING THIS IS ABSOLUTELY CRUCIAL TO DOING WELL AT MODULE 1

Wednesday 30 December 2009

No 48: The Economic Future of Russia and China

THE SUNDAY Telegraph printed this article about the economic prospects for China, Russia, the USA and India.

As always, there is the opportunity for you to improve your economic analysis here, if you agree to take the challenge young Jedi.

For Russia, the article suggests possible difficulties may come from over-reliance on oil and gas exports, and resistance to required reform. Think about how you would explain these problems in the context of an essay.

For China, problems may arise from the economy continuing to grow too quickly, particularly increasing inflationary pressures and asset bubbles. Again, think about how you would explain these difficulties if you were writing about them.

Let me know what you think about the article and/or the future economic prospects for your country....

No 47: If you have 2 minutes to spare....

The heat map feature also on this page is useful way of reading brief summaries of the main stories, as shown below :

No 46: If you have a minute to spare....

YOU can watch the artist for the Guardian newspaper draw this cartoon about the UK banking crisis.

Monday 28 December 2009

No 45: The key Unit 1 (Microeconomics) Question?

I DO NOT have any special knowledge at all about which questions will be in your January exams. However, it seems to me that for Unit 1 we must remember the title of the module - "Markets and Market Failure".

One of the many results of the Credit Cruch has been a lot of doubt about arguments in favour of free markets. In the past 15 or so years, the common belief was that financial markets should be as free from government intervention as possible. You only have to look at the current economic situation to see why many economists have argued that market failure has resulted.

Additionally, we all know that environmental considerations are key issues of our time. For these problems, there is a debate about whether free market or government led solutions will be the most effective.

Therefore, being able to discuss the advantages and disadvantages of free markets, and the advantages and disadvantages of government action, should be an important part of your Unit 1 revision.

Here is a sample of a question related to this topic:

Using the data and your economic knowledge, evaluate the effectiveness of using the market mechanism to solve environmental problems.

I suggest we try and work on this question together, so please comment below on how you would try and answer this.

One of the many results of the Credit Cruch has been a lot of doubt about arguments in favour of free markets. In the past 15 or so years, the common belief was that financial markets should be as free from government intervention as possible. You only have to look at the current economic situation to see why many economists have argued that market failure has resulted.

Additionally, we all know that environmental considerations are key issues of our time. For these problems, there is a debate about whether free market or government led solutions will be the most effective.

Therefore, being able to discuss the advantages and disadvantages of free markets, and the advantages and disadvantages of government action, should be an important part of your Unit 1 revision.

Here is a sample of a question related to this topic:

Using the data and your economic knowledge, evaluate the effectiveness of using the market mechanism to solve environmental problems.

I suggest we try and work on this question together, so please comment below on how you would try and answer this.

No 44: Monetary Policy Presentation

HERE is a link to an excellent Tutor2U presentation on monetary policy for AS level:

AS Monetary Policy

I've captured a few of the most important slides below. Firstly, it's very important to remember that monetary policy decisions are made now on what conditions are predicted to be in the future, due to time lags:

Next, here is an extremely useful list of points to remember when evaluating the effectiveness of monetary policy:

However, don't be lazy, read the whole thing!

AS Monetary Policy

I've captured a few of the most important slides below. Firstly, it's very important to remember that monetary policy decisions are made now on what conditions are predicted to be in the future, due to time lags:

Next, here is an extremely useful list of points to remember when evaluating the effectiveness of monetary policy:

Finally here is a list of key concepts that if you use in your exam will present an advnaced level of analysis:

Friday 18 December 2009

No 42: More about market power and Cadbury

HERE is a report from the Tutor2U website:

Embroiled in what looks likely to be a protracted takeover bid from Kraft, Cadbury’s has suffered a blow with the news that its share of the UK confectionery market has dipped below 30 per cent for the first time in a while.

The Times reports that Cadbury’s chunk of the chocolate market by value slipped 1.7 per cent to 29.8 per cent last month, the first time that it has fallen below 30 per cent all year. Market share of Mars, its biggest rival, slipped 0.6 per cent in the period.

There are signs that aggressive pricing of basic chocolate bars by discount retailers such as Aldi and Lidl is having an effect; so too is the growth of sales for own-brand bars offered by Tesco, Sainsbury’s and the ongoing battle for customers between Waitrose and Marks and Spencer.

Some customers have complained about a 75% rise in the price of a 230g bar of Dairy Milk in the last 12 months. High world cocoa prices have explained some of the price hike but Cadbury’s tactic of launching a new 100g bar priced at £1 had led some to claim that their are deliberately trying to anchor their prices at a higher level to raise profit margins as a defence against the takeover bid. The decline in market share suggests that chocoholics are more price sensitive than Cadburys might have forecast.

It seems to me that part of the skill of being an economist is to be able to quickly identify the connection between real-world events (such as described above) to as many economic ideas as possible. The comment below lists the concepts I think are in the article. Before you look at the comment, see which ones you can identify yourself.

An excellent economics students is able to take the suggestions of just a few sentences of data and write a 3 page essay about it.

An excellent economics students is able to take the suggestions of just a few sentences of data and write a 3 page essay about it.

Thursday 17 December 2009

No 41: Decline of Internet Explorer

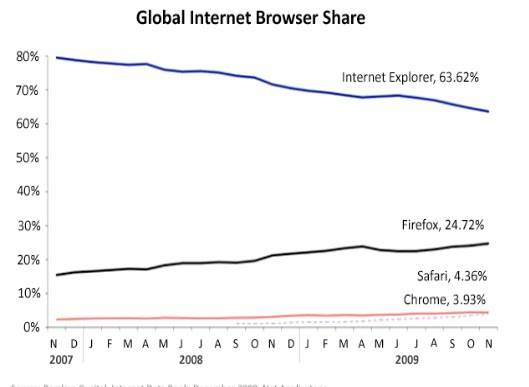

IN AS classes we have been talking about Microsoft and monopoly power. Here is a chart showing changes in the browser market:

This raises a number of questions:

1) What are the key changes shown in the diagram?

2) Which problems could arise from one company having such a large market share?

3) What are some economic explanations for the decline in IE's market share?

4) Can problems with monopoly power be best solved by using government intervention or by relying on the free market?

All of these are possible exam questions, so if you are doing one soon, you may want to consider your answers and perhaps leave a comment below.

1) What are the key changes shown in the diagram?

2) Which problems could arise from one company having such a large market share?

3) What are some economic explanations for the decline in IE's market share?

4) Can problems with monopoly power be best solved by using government intervention or by relying on the free market?

All of these are possible exam questions, so if you are doing one soon, you may want to consider your answers and perhaps leave a comment below.

Friday 11 December 2009

No 38: Friday Fun Returns

IN the Spottygao household, much time last night was spent playing this - "Oiligarchy".

http://onemorelevel.com/game/oiligarchy

I began by disapproving of the terrible way I was behaving in the game: destroying the environment, putting oil wells in people's villages or the untouched oceans, paying politicians to promote the interests of oil, and authorising secret operations to take over Iraq. By the end I had turned into a profit crazed oil tycoon.

Thursday 10 December 2009

No 37: Your country compared to US states

DID you know California has the same GDP as France and Ohio the same as Australia? Here is a map which shows the states of the USA and which countries match their GDP levels:

(Click on the map if you want to make it bigger.)

It comes from one of my favourite blogs - "Strange Maps" http://strangemaps.wordpress.com/ .

The USA is not the biggest country in the world nor the richest. But, as the map shows, it is certainly the richest big country.

(By the way, if you need to know the real names of the US states, go to this http://www.onlineatlas.us/map/united-states-map.gif )

(Click on the map if you want to make it bigger.)

It comes from one of my favourite blogs - "Strange Maps" http://strangemaps.wordpress.com/ .

The USA is not the biggest country in the world nor the richest. But, as the map shows, it is certainly the richest big country.

(By the way, if you need to know the real names of the US states, go to this http://www.onlineatlas.us/map/united-states-map.gif )

No 36: Poor Darling!

If you never thought you'd feel sorry for Mr Darling, look at this cartoon:

http://news.bbc.co.uk/1/hi/business/8402362.stm

Of course I'm sure by now all of you have read about what he proposed in yesterday's Pre Budget Statement, but in case you haven't, this summarises the main comments and proposals he made:

http://news.bbc.co.uk/1/hi/uk_politics/8403636.stm

We were discussing in afternoon A2 class which of these are the most important, and decided on:

1. The tax on bankers' bonuses

2. The raise in National Insurance

3. The commitment to halve the budget deficit by 2013

4. The return of VAT to 17.5%

In general, he seems he is favouring raising taxes over cutting spending, perhaps since the latter is particularly dangerous just before an election.

However, we all know that the most important of all is ............................ the reduction of tax on BINGO!

http://news.bbc.co.uk/1/hi/business/8402362.stm

Of course I'm sure by now all of you have read about what he proposed in yesterday's Pre Budget Statement, but in case you haven't, this summarises the main comments and proposals he made:

http://news.bbc.co.uk/1/hi/uk_politics/8403636.stm

We were discussing in afternoon A2 class which of these are the most important, and decided on:

1. The tax on bankers' bonuses

2. The raise in National Insurance

3. The commitment to halve the budget deficit by 2013

4. The return of VAT to 17.5%

In general, he seems he is favouring raising taxes over cutting spending, perhaps since the latter is particularly dangerous just before an election.

However, we all know that the most important of all is ............................ the reduction of tax on BINGO!

Sunday 6 December 2009

No 35: Useful Stuff from the Guardian 2

NEXT, explanation of what QE is and how it works:

http://www.guardian.co.uk/business/2009/aug/06/quantitative-easing-questions-and-answers

And this shows Bank of England interest rates from 1694 (!) onwards:

http://www.guardian.co.uk/business/interactive/2008/nov/05/interest-rates-history

Finally, not from the Guardian but somewhat of an explantion for the need to expand the money supply....................

http://www.guardian.co.uk/business/2009/aug/06/quantitative-easing-questions-and-answers

And this shows Bank of England interest rates from 1694 (!) onwards:

http://www.guardian.co.uk/business/interactive/2008/nov/05/interest-rates-history

Finally, not from the Guardian but somewhat of an explantion for the need to expand the money supply....................

No 33: Diamonds Aren't Forever

Q: WHICH business has seen its profits this year fall by 99%?

A: DeBeers, the world's largest producer of diamonds such as worn here....

A: DeBeers, the world's largest producer of diamonds such as worn here....

This article explains what has happened:

There are a couple of economics ideas you should keep in mind when reading. First, there are obvious effects here due to a high income elasticity of demand, remembering that income and thus demand, can fall as well as rise.Second, there has been increased competition from countries like Russia, Canada and Australia.

Remember as economists we don't take the side of a particular company but try to assess if changes in a market are good or bad for the economy, its efficiency and overall welfare.

Tell me what you think below....

No 32: Bellerbys Nobel Prize for Economics

THE WINNER of the Bellerbys Nobel Prize for Economics for November 2009 is Hsin Qin (Tang) for his work about Keynes (see post 10).

As you can see, he was very pleased to receive an excellent prize along with temporary possession of the Bellerbys Nobel Prize Medal (formerly a football medal I won in 1997):

Now, I am sure you are all very jealous of Tang here, so I am expecting many many entries to December's Nobel Prize competition, which will be revealed very soon.

As you can see, he was very pleased to receive an excellent prize along with temporary possession of the Bellerbys Nobel Prize Medal (formerly a football medal I won in 1997):

Now, I am sure you are all very jealous of Tang here, so I am expecting many many entries to December's Nobel Prize competition, which will be revealed very soon.

Thursday 3 December 2009

No 31: Countdown to December 9th

SINCE this will be when Alistair Darling makes the very important Pre-Budget report, announcing the latest government plans to try and help the economy recover.

The Daily Telegraph has a special section dedicated to what might happen:

http://www.telegraph.co.uk/finance/financetopics/budget/

which gives us an excuse for a silly picture

I met Mr. Darling last summer (that is not a picture of it by the way). He was getting into a car at the back of Brighton station as I was walking to school. I asked him to come to my 9 o'clock class but he said he couldn't. Nevertheless, he seemed like a nice man. His haircut looked very expensive and neat. Also, even though he had 6 helpers with him, he was carrying his own bag.

(Note: all of the above paragraph is actually true, apart from one sentence.)

The Daily Telegraph has a special section dedicated to what might happen:

http://www.telegraph.co.uk/finance/financetopics/budget/

which gives us an excuse for a silly picture

I met Mr. Darling last summer (that is not a picture of it by the way). He was getting into a car at the back of Brighton station as I was walking to school. I asked him to come to my 9 o'clock class but he said he couldn't. Nevertheless, he seemed like a nice man. His haircut looked very expensive and neat. Also, even though he had 6 helpers with him, he was carrying his own bag.

(Note: all of the above paragraph is actually true, apart from one sentence.)

No 29: The history of economics in video

HERE it is, the entire history of economics since 1914.

I highly recommend that all economics students try to watch this.

True, the entire "Commanding Heights" series runs to 6 hours, but if you manage to watch all before next June's exams, you will have gained an invaluable overview that will help you be even more successful.......

http://www.pbs.org/wgbh/commandingheights/hi/story/index.html

I highly recommend that all economics students try to watch this.

True, the entire "Commanding Heights" series runs to 6 hours, but if you manage to watch all before next June's exams, you will have gained an invaluable overview that will help you be even more successful.......

http://www.pbs.org/wgbh/commandingheights/hi/story/index.html

No 28: GDP Comparison Tool

OF all the activities I do with you guys, the one that seems to get the most response is when we compare countries' GDP. This is a great way to do this:

http://snippets.com/what-is-the-gdp-per-capita-for-every-country.htm

http://snippets.com/what-is-the-gdp-per-capita-for-every-country.htm

Tuesday 1 December 2009

No 27: Busy time at the moment.....

... end of term tests and reports to do, speed of new posting may be a little slower next couple of days, sorry!

Sunday 29 November 2009

No 26: New news

Just some links to 3 stories you should take a look at:

1. Trouble in paradise: huge problems in Dubai which may possibly mean a new stage of the global credit crisis.

2. Secret dealings come to light: the £61 billion given in secret loans to banks by the UK government last year has been revealed.

http://news.bbc.co.uk/1/hi/business/8378087.stm

3. But don't worry, the robots will save us:

1. Trouble in paradise: huge problems in Dubai which may possibly mean a new stage of the global credit crisis.

2. Secret dealings come to light: the £61 billion given in secret loans to banks by the UK government last year has been revealed.

http://news.bbc.co.uk/1/hi/business/8378087.stm

3. But don't worry, the robots will save us:

Friday 27 November 2009

No 23: New Friday Fun

THIS is a link to the best economics game I have yet found on the net - "Budget Hero". It asks you to take control of the US economy and make decisions about spending and taxation. As a teacher, of course, I like the amount of educational detail it contains, but it can also be played mostly just for fun if education is not your objective >:O

http://marketplace.publicradio.org/features/budget_hero/

Wednesday 25 November 2009

No 22: Poor Gordon

HERE is a Times article about Gordon Brown's 10 worst finanical mistakes as Prime Minister and Chancellor:

http://timesbusiness.typepad.com/money_weblog/2009/06/gordons-10-worst-financial-gaffs.html

The list is:

1. Taxing dividend payments

2. Selling our gold

3. Tripartite financial regulation

4. Tax credits

5. The £10,000 corporation tax threshold

6. Abolition of the 10p tax rate

7. Failing to stop the housing bubble

8. 50 per cent tax rate

9. Cutting VAT

10. Public-sector borrowing

You can also vote on the site for which you think is the worst.

Personally, I think it is terribly unfair that it is not possible to vote for "None of them were mistakes".

No 21: Cadbury takeover story

ALWAYS a very good idea to put together what you are learning in class at the moment with current events.

Currently my AS students and I are discussing monopoly power. The big news story in this area is about various companies wanting to take over Cadbury who make this:

Currently my AS students and I are discussing monopoly power. The big news story in this area is about various companies wanting to take over Cadbury who make this:

Here is a video from Fox News about this story:

And here is the BBC news report about it:

Tuesday 24 November 2009

No 20: Talks last week

LAST week was a good one for interesting talks.

Apart from Mr. Krawiec's on Friday afternoon - see previous post, and make sure to ask any really hard questions about it to economics teachers who are not me :) - two students made presentations in my A2 classes.

In the morning A2 class, Yerke Bektayev spoke about this article on gender discrimination:

http://news.bbc.co.uk/1/hi/business/8366765.stm

We won't fully study theories of discrimination until A2 Module 3, but it is an interesting issue, particularly the question of whether or not there should be "positive discrimination" in favour of certain groups.

In the afternoon class, Sanzhar Ospanov picked this "Economist" story about China's amazing productivity improvements:

http://www.economist.com/businessfinance/economicsfocus/displaystory.cfm?story_id=14844987

This introduces the idea of total factor productivity (TFP) which is fast becoming the accepted measure, as well as providing very useful details about how a country can successfully improve the productivity of its economic resources.

Thanks to all these interesting speakers!

(Note: also many thanks to Mr. Krawiec for allowing me to post his presentation on this blog.)

Apart from Mr. Krawiec's on Friday afternoon - see previous post, and make sure to ask any really hard questions about it to economics teachers who are not me :) - two students made presentations in my A2 classes.

In the morning A2 class, Yerke Bektayev spoke about this article on gender discrimination:

http://news.bbc.co.uk/1/hi/business/8366765.stm

We won't fully study theories of discrimination until A2 Module 3, but it is an interesting issue, particularly the question of whether or not there should be "positive discrimination" in favour of certain groups.

In the afternoon class, Sanzhar Ospanov picked this "Economist" story about China's amazing productivity improvements:

http://www.economist.com/businessfinance/economicsfocus/displaystory.cfm?story_id=14844987

This introduces the idea of total factor productivity (TFP) which is fast becoming the accepted measure, as well as providing very useful details about how a country can successfully improve the productivity of its economic resources.

Thanks to all these interesting speakers!

(Note: also many thanks to Mr. Krawiec for allowing me to post his presentation on this blog.)

No 18: Two videos you really MUST watch

OUR economics coursebooks and syllabi are still yet to catch up with events started by the credit curnch over the past year. This means we have to educate ourselves about them, since, in my opinion at least, any student of macroeconomics is badly informed who doesn't know about, for example, quantatitive easing.

There are two extremely useful videos to help us with this. I show both of them to all my classes. If you haven't seen them, watch them now, and I make no apologies for showing them again in class in future. If you've seen them, watch them again.

KNOWLEDGE OF THE TOPICS CONTAINED IN THESE VIDEOS MAY SEPARATE THE TOP STUDENTS FROM THE OTHERS WHEN IT COMES TO OUR FINAL EXAMS.

The first is called the "Crisis of Credit" and explains the events that led to the credit crunch:

http://www.crisisofcredit.com/

The second is a part of the excellent Marketplace website's whiteboard series, and explains what governments are trying to achieve with quantitative easing:

http://marketplace.publicradio.org/display/web/2008/12/22/whiteboard_quantitative_easing/

Spot of Economics Health Warning: Watching These Videos May Seriously Improve Your Economics Knowledge!

There are two extremely useful videos to help us with this. I show both of them to all my classes. If you haven't seen them, watch them now, and I make no apologies for showing them again in class in future. If you've seen them, watch them again.

KNOWLEDGE OF THE TOPICS CONTAINED IN THESE VIDEOS MAY SEPARATE THE TOP STUDENTS FROM THE OTHERS WHEN IT COMES TO OUR FINAL EXAMS.

The first is called the "Crisis of Credit" and explains the events that led to the credit crunch:

http://www.crisisofcredit.com/

The second is a part of the excellent Marketplace website's whiteboard series, and explains what governments are trying to achieve with quantitative easing:

http://marketplace.publicradio.org/display/web/2008/12/22/whiteboard_quantitative_easing/

Spot of Economics Health Warning: Watching These Videos May Seriously Improve Your Economics Knowledge!

Sunday 22 November 2009

No 17: Minimum price for vodka

ALMOST as if they knew that us in AS classes will be studying the topic of demerit goods this week, the Russian government has announced it is going to introduce a minimum price for cheap vodka.

http://www.rferl.org/content/Russian_Commission_Approves_Setting_Minimum_Price_For_Vodka/1882839.html

http://www.rferl.org/content/Russian_Commission_Approves_Setting_Minimum_Price_For_Vodka/1882839.html

This kind of behaviour may have led to them doing this:

An alternative argument about this topic which you may not find in your textbooks:

- Control of demerit goods is argued for not only because of the high level of negative externalities, but since consumers are presumed to have less than perfect knowledge about these goods' private costs.

- However, it may be that consumers have made a fairly rational decision based on weighing up utility with possible costs, discounting any costs coming far into the future. As we saw last week Keynes said in a different context "in the long run, we are all dead" :( . I don't know any smokers, for example, who are unware of the health risks of their habit.

- Therefore it could be argued that all government action achieves here is a restriction of individual choice and interference with consumer's pleasure and business's profit.

No 16: These videos look good but.......

DISCOVERED here the Economist audio and visual page, with lots of interesting looking items

http://audiovideo.economist.com/

BUT my Flash Player is not working, so please let me know if any particular clips are good.

Friday 20 November 2009

No 13: More about Queen's speech

HERE is a slightly easier to understand report about the Queen's Speech, as requested by some students:

http://www.channel4.com/news/articles/politics/queenaposs+speech+aposan+election+ruseapos/3428197

http://www.channel4.com/news/articles/politics/queenaposs+speech+aposan+election+ruseapos/3428197

No 12: Friday Fun

SORRY I realise the last couple of posts have asked you poor students to do some academic style work, so time to relax and have a try at this game, where you use your knowledge to run a farm:

http://www.bized.co.uk/virtual/vla/farm/index.htm

If you play it, post your best score and next Friday I'll put up a high-score table on the blog.

Hopefully you will do better than I did here:

http://www.bized.co.uk/virtual/vla/farm/index.htm

If you play it, post your best score and next Friday I'll put up a high-score table on the blog.

Hopefully you will do better than I did here:

It appears I should remain a teacher.

Thursday 19 November 2009

No 11: The Queen's Speech

YESTERDAY was the Queen's speech. This is the occasion on which she reads out the government's proposed new laws for the forthcoming year. Historically, it is the only time of the year that the King or Queen is allowed to go inside the House of Lords. He or she is never allowed inside the House of Commons.

Here is a link to a BBC report about the laws proposed yesterday:

For AS students doing micro at the moment:

read through the list and think of the market failures some of the laws are trying to correct.

For A2 students doing macro:

- read through the proposed actions against bankers and the commitment to reduce the deficit.

Please post your comments below: I'm sure it will really help your fellow students to share ideas like this.

Wednesday 18 November 2009

No 10: Keynes Quotes COMPETITION

FOR those neo-Keynesians who may be upset by the earlier post about Hayek (by the way, A2 economists should be deciding where they stand in the Keynesian - Classical economics argument), here are some quotes from Keynes which are quite relevant to current economic events.

1) "If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has."

2) "The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again."

3) "If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coal mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well tried principals of laissez-faire to dig the notes up again ...... there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. "

THE FIRST STUDENT TO POST A COMMENT WHICH CORRECTLY LINKS EACH QUOTE TO AN ASPECT OF THE CREDIT CRUNCH WILL GET A PRIZE!!!!!!!!!!!!

1) "If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has."

2) "The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again."

3) "If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coal mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well tried principals of laissez-faire to dig the notes up again ...... there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. "

No 8: 2 Hayeks

2 FAMOUS people with the surname "Hayek".

One a Nobel prize winner, and passionate defender of the free market, not only for its ability to create wealth, but as a defence against evil government control of society. These ideas are summarised in this Hayek's book "The Road to Serfdom" (published 1944) which you can see here in the form of a cartoon:

http://mises.org/books/TRTS/

(No Nobel prize yet for the other Hayek but she did win the 1998 MTV Movie Award for best teenage date movie.)

Other famous free market economists apart from Friedrich (not Salma) Hayek are Ludwig von Mises, Gary Becker and Milton Friedman. I'll try to post about some of them at a later date.

Tuesday 17 November 2009

No 7: Phillips Machine

THIS wondrous sight (not the strange professor) is the Phillips' Machine, invented by Bill Phillips, New Zealand Engineer and Economist, and also responsible for the Phillips' Curve. He built 14 of these machines, which model the economy using flows of water. This one was constructed for the LSE.

This video shows how it works:

Ah, if only the real economy could be controlled in this way. More advanced students might want to consider the advantages and disadvantages of modelling the economy in such a mechanistic Newtonian manner, and how recent Mathematical and Biological theories would challenge this.

Or you may prefer to watch funny cats on youtube......

No 6: Is your country in or out of recession?

THE lovely chart you see above (and yes, to be a true economist you need to find diagrams beautiful) is an interactive item from the Guardian.

You can hover over the planet like some alien visitor and find out about how GDP growth varies across the world at the moment.

Sorry though, you may not find your country on the chart :.(

No 5: New Inflation Figures

INFLATION figures for October: CPI now 1.5% from 1.1.%. RPI now -0.8% from -1.4%.

A reminder to all A-level students, you really need to remember, AT THE VERY LEAST, the current UK stats for inflation, unemployment and growth.

A reminder to all A-level students, you really need to remember, AT THE VERY LEAST, the current UK stats for inflation, unemployment and growth.

I will be testing you!!!! >:O

Monday 16 November 2009

No 4: Dragons' Den for Economists

MEMBERS of the public suggest new taxes for the approval of economics experts in this Newsnight video named "Politics Pen".

http://news.bbc.co.uk/1/hi/programmes/newsnight/8352611.stm

Despite unlikely how this might sound, my A2 class and I honestly had an enjoyable time afterward discussing the best methods of increasing tax revenue and how this related to Adam Smith's cannons of taxation, which are, anybody?

http://news.bbc.co.uk/1/hi/programmes/newsnight/8352611.stm

Despite unlikely how this might sound, my A2 class and I honestly had an enjoyable time afterward discussing the best methods of increasing tax revenue and how this related to Adam Smith's cannons of taxation, which are, anybody?

No 3: Recession tracker

THIS is a link to the BBC resource tracking the course of the current recession.

THIS is a link to the BBC resource tracking the course of the current recession.With info like that over there about all the key macro indicators, it's sure to be fun for all the family.

Hats off to Ms Rossiter for the suggestion.

No 2: About

SO this blog and related resources are for my students, my ex-students, my colleagues, and their students.

Its purpose is to discuss economics news and direct you to useful resources.

How much and how often I post will probably depend on how much I feel this is being used. Please let me know if you are reading with comments and suggestions.

Its purpose is to discuss economics news and direct you to useful resources.

How much and how often I post will probably depend on how much I feel this is being used. Please let me know if you are reading with comments and suggestions.

Subscribe to:

Posts (Atom)