CHARTS OF 2010 - A YEAR IN NINE PICTURES

THE global property bust that pulled the world into recession in 2008 began to lift in 2010. House prices turned up in Britain and stabilised in America (chart 1) but slid further in Spain. The process of deleveraging kept rich-world inflation subdued (chart 2) while robust demand and loose monetary policy let it accelerate in India and China. By late 2010 output and employment had turned up in most rich countries but not enough to regain pre-crisis levels (chart 3).

Bowing to American pressure, China allowed the yuan to rise slightly (chart 4); higher inflation meant that in real terms it rose considerably more. Japan watched in alarm as a rising yen (chart 5) threatened its export-led recovery. Europe trembled as its sovereign-debt crisis undermined the euro.

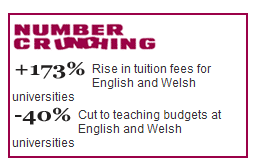

Rich-world budgets remained deeply in deficit but at least those gaps generally shrank, most of all in countries, like Greece, undergoing austerity (chart 6).

Sadly, austerity did not provide the hoped-for relief: peripheral European government-bond yields continued to rise relative to Germany’s (chart 7).

Bonds’ best days may be over everywhere. In emerging markets and America bond prices increased through most of 2010 (chart 8) then fell as America’s economy sprang to life and investors flocked to equities. Commodities trounced both stocks and bonds (chart 9). Bulls attribute this to global growth, especially in the emerging world; bears cite a desire for inflation hedges. The tension between them will drive markets in 2011.